Elevating IR: Key Insights from Q4’s AI Masterclass in Toronto

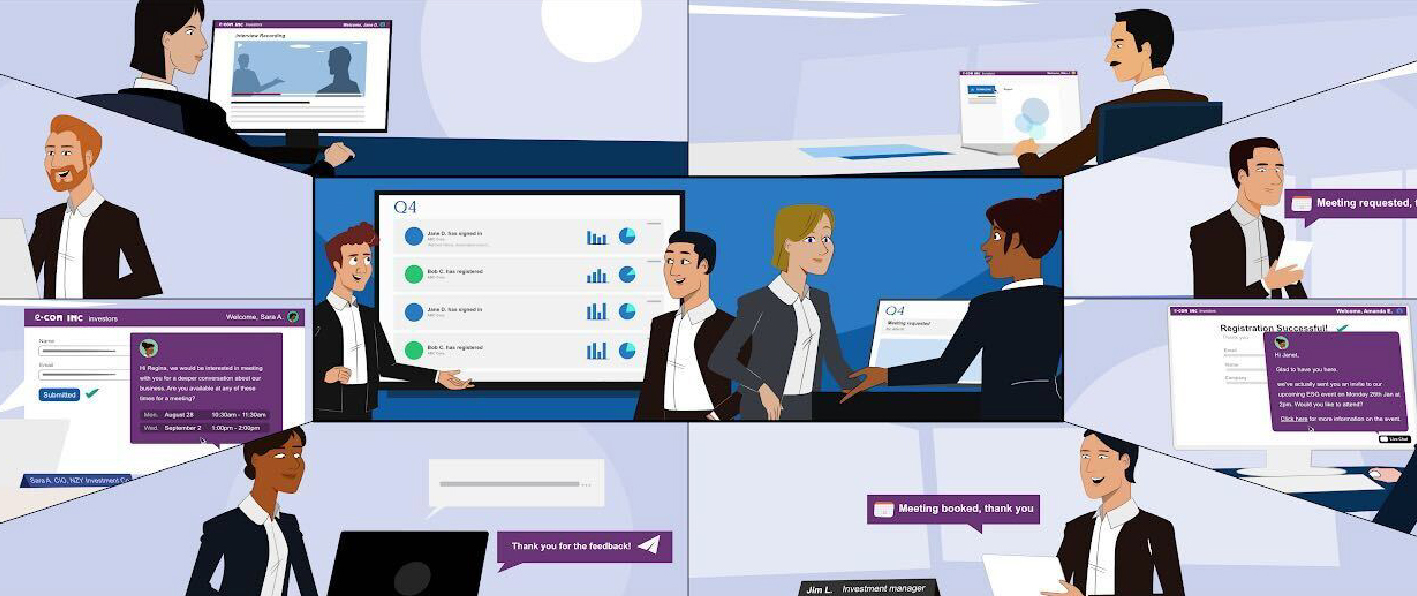

At Q4’s recent IR Masterclass: Leveraging AI & Tech for Success, IR professionals gathered at the Toronto office to explore how AI is reshaping capital markets communications. Led by Q4 Founder and CEO Darrell Heaps alongside guest speaker Alyssa Barry, President of Alliance Advisors IR, the session delivered live demonstrations and real-world insights with a clear message: purpose-built AI isn’t just changing how IR teams work. It’s elevating their strategic impact.