Incans | Q1 2023 Income Analytics T200 reports

June 20th 2023, London. The latest T200 reports from Income Analytics (INCANS) shows the UK hospitality tenants continuing to be the best improvers, albeit from a low base after the pandemic. However, their European counterparts have not shown as much improvement. European pubs & restaurant scores have remained static over the last 12-months. In the US however the same tenants are seeing falling scores. Perhaps discretionary spend has been hit harder in the United States. Motor dealerships, a representation of larger discretionary spending, has seen tenant scores (and therefore the likelihood of default) fall across all three regions.

Matthew Richardson, CEO and Co-Founder of Income Analytics commented “the security of income is at the forefront of our clients’ minds, and we’re pleased to be able to provide these headline market averages to help identify sectors most at risk.”

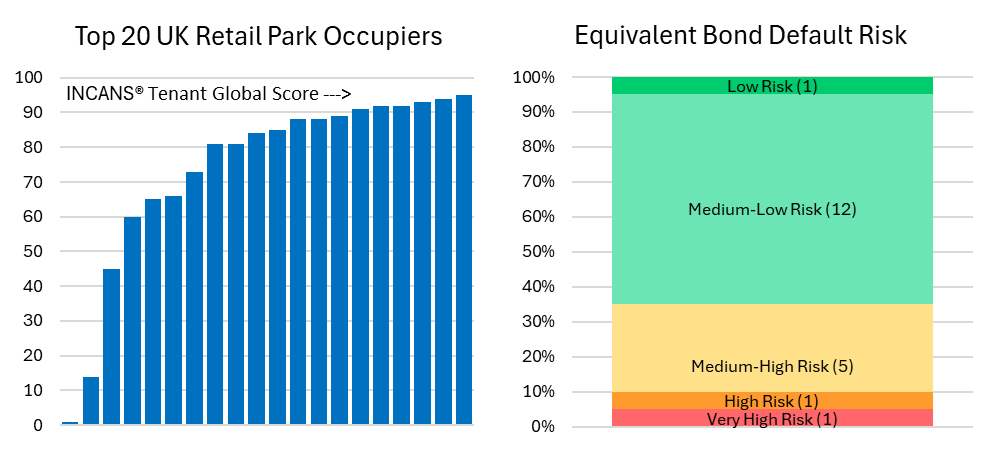

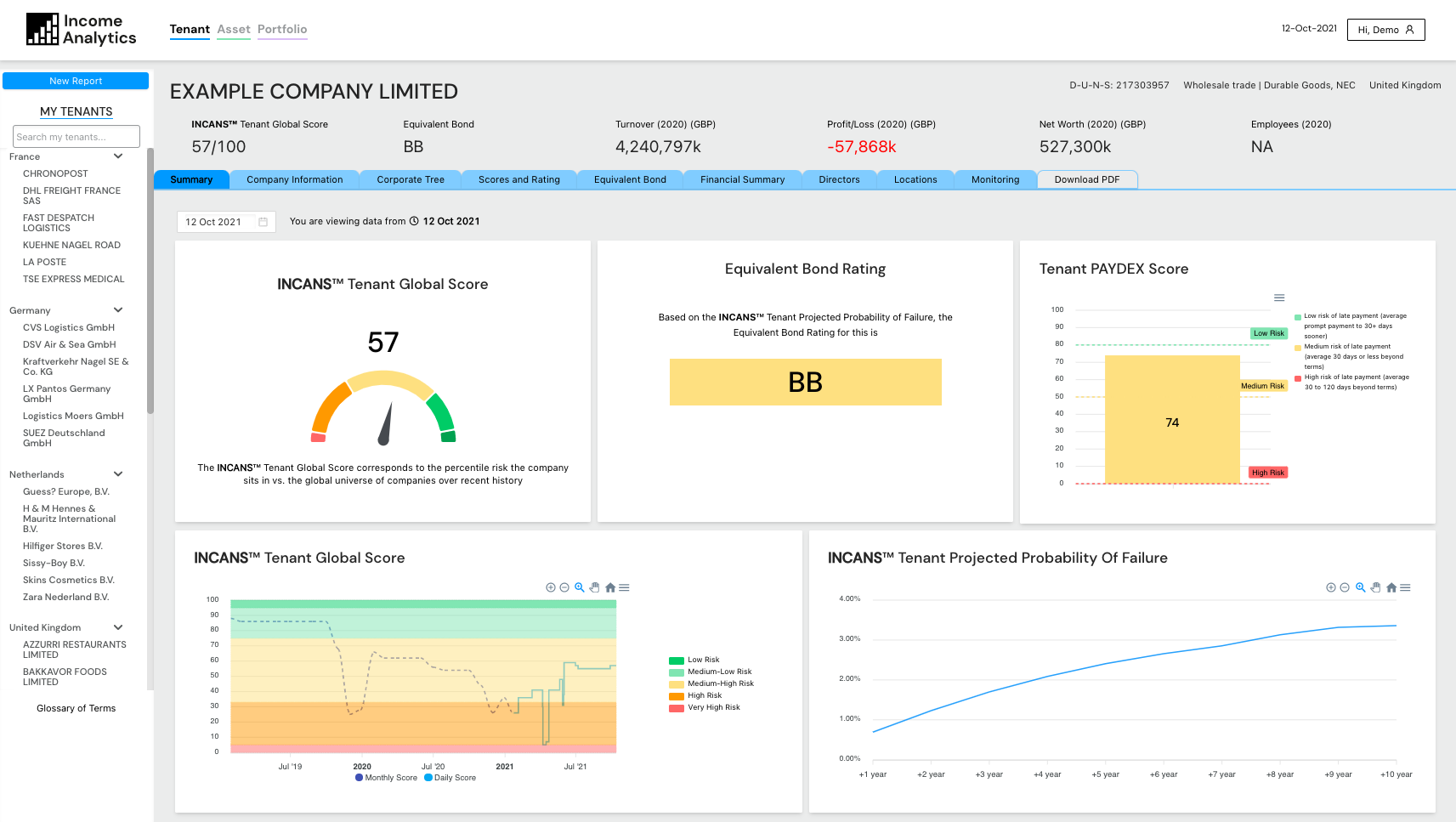

The INCANS® T200 series of reports have been developed by Income Analytics using company level data provided by Dun & Bradstreet. The figures are calculated at the end of each quarter by generating an average % probability of failure for the top 200 companies in each of the 83 SIC 2 industry code type. Income Analytics provides reports for the UK, Western Europe and North America.

Download the reports here:

-1.jpg)

-1.png)