Incans | Tenant Monitoring Service

Our new feature allows tenant monitoring and score tracking, meaning you can easily track corporate structure changes and financial health among all your tenants.

Watch our introductory video HERE.

Posts by:

Our new feature allows tenant monitoring and score tracking, meaning you can easily track corporate structure changes and financial health among all your tenants.

Watch our introductory video HERE.

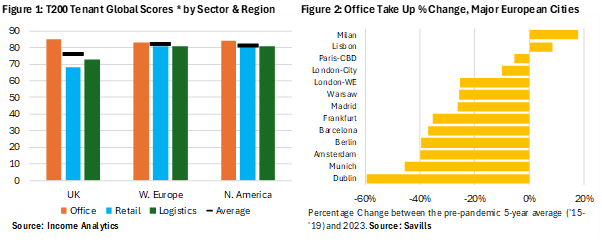

Office landlords and investors find themselves at a tricky inflection point. Income Analytics’ T200 time-series show that the typical institutional office occupier’s credit rating has, on average, remained relatively stable and the average is usually one of the highest recorded for the traditional investment sectors (Figure 1). Many of the occupiers of the largest HQ buildings, such as banks, are also recording record profits. On paper, office investments should deliver the stable income returns investors are seeking.

Yet, as data from Savills shows (Figure 2) take-up of office space across major European cities is significantly trailing historical averages. Landlords are having to adjust to the new norm in many locations – their traditional occupiers are struggling to get employees to return full-time to the office, and therefore have less need for office space. Occupiers are rationalising their footprints to focus on areas that can attract employees back to the office – for instance, areas that are well connected to the transport networks.

The result is office values are falling and transaction activity is depressed in the first half of 2024. With fewer new tenants hunting for space, and incentives offered by landlords higher, it becomes more important to ensure that the tenant secured for buildings are strong, stable businesses – a landlord does not want to find they secure a tenant, provide build out incentives; only to find the tenant is out of business within a few years. Income Analytics’ INCANS® helps our clients with the due diligence on the prospective tenant as well as allow a view across the corporate tree to find the right place for a rental guarantee should one be needed.

There remains a place for office in an investor’s portfolio, with the adage that it needs to be well-located, good quality with a strong, stable low-risk tenant base generating income.

* The INCANS® Tenant Global Scores predict the likelihood that a company will seek credit relief or fail, 1 being the worst. The T200 series quantifies the default risk across the top 200 standard industry classifications (SICs) for the UK, Western Europe and North America.

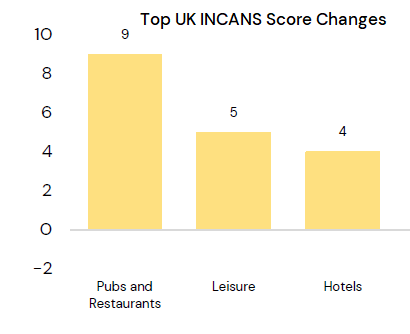

August 22nd 2023, London. The latest T200 reports from Income Analytics (INCANS) shows a mixed picture for retail sector tenants across the UK, Western Europe and North America. In Europe, retailers score below their regional averages, while in North America they trend above the average. The leisure sector has improved but remains below average in Western Europe, while has rebounded after the pandemic to score above average in the UK and North America.

Our latest reports highlight the key regional trends for real estate occupiers.

The INCANS® T200 series of reports have been developed by Income Analytics using company level data provided by Dun & Bradstreet. The figures are calculated at the end of each quarter by generating an average % probability of failure for the top 200 companies in each of the 83 SIC 2 industry code type. Income Analytics provides reports for the UK, Western Europe and North America.

Download the reports here:

.png)

Data released by the UK’s The Insolvency Service on 16th June 2023 showed that company insolvencies were up 40% in May 2023 compared to May 2022. They noted that this is higher than levels seen under Government Covid support measures, and higher than pre-pandemic numbers.

Maximising and securing tenant generated revenue is what real estate investment is all about. How well are you monitoring your tenants? The Income Analytics solution helps real estate professionals quantify, monitor and report tenant income risk.

Contact us for more information at info@incans.com

Income Analytics is pleased to release its latest T200 reports. Our T200 series quantifies the default risk across the top 200 standard industry classifications (SICs) for the UK, Western Europe and North America. Individual companies are given a score, reflecting their default risk, with a higher score indicating a lower probability of failure or default.

Our latest analysis focused on movements over the last year. In North America and the United Kingdom while scoring has changed, the ranks of key sectors have barely changed. Office and Leisure have swapped position in North America, and Retail climbed one spot to 6th in the United Kingdom leaving Industrials in last spot.

There has been more movement in Europe with Office tenants climbing two spots to third place, however that was more due to Logistics falling two spots. The hospitality sector has shown improvement while Retail dropped to last place.

Watch our video about using our ReWind feature

We are delighted to inform you that we have released a new feature on the Portfolio Income Manager dashboard. This is as a result of feedback from clients with regards the challenges and cost in time to look back at historical performance of a portfolio, fund or asset.

The feature is called ReWind and enables you to go back in time and look at historical data on your portfolio from any point in time since you purchased it. To watch a 90 seconds video on how to use it then click HERE.

Matt Richardson had the chance to speak with Real Asset Media at Expo Real 2023.

This 2-minute interview offers Matt's thoughts on the challenges facing the sector over the next 12-24 months, as well as the opportunities that will emerge.

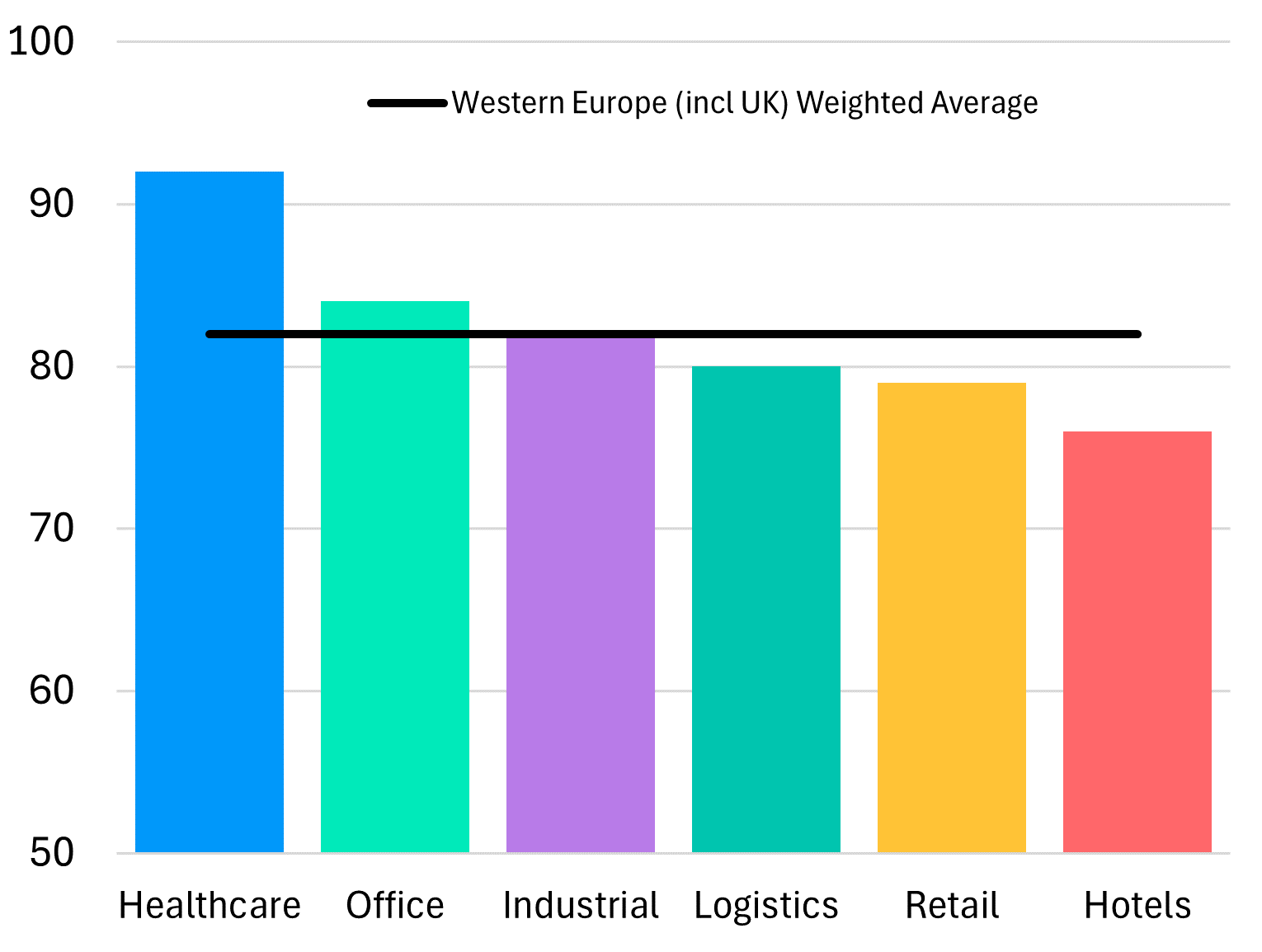

Income Analytics is pleased to release its latest T200 reports. Our T200 series quantifies the default risk across the top 200 standard industry classifications (SICs) for the UK, Western Europe and North America. Individual companies are given a score, reflecting their default risk, with a higher score indicating a lower probability of failure or default.

Our latest analysis of typical Western European tenants show there is a 16-point gap between the best scoring grouping (Healthcare companies) and the worst core grouping (Hotels). However, as we have demonstrated previously in this post there are significant ranges within these groups so the best hotel companies may well be similar to the best healthcare companies. It is important for investors to track and monitor their specific tenants to ensure they have the right mix of tenants to ensure the durability of their income streams.

The sectors that still make up most real estate investors portfolios (office, logistics and retail) are closer to the Western European average though retail remains the worst performer.