How Outsourcing Tax Preparation Services Increase CPA Firm’s Profitability?

Outsourcing tax preparation services allow CPA firms to save up to 50% of their operational cost, be it time, money, or people. It also provides the ability to manage...

Outsourcing tax preparation services allow CPA firms to save up to 50% of their operational cost, be it time, money, or people. It also provides the ability to manage...

Most CPAs and accounting firms are skeptical about the real impact of outsourced bookkeeping services on their business. What they frequently fail to consider is the higher cost of not having this accounting support.

Nowadays, it is difficult for CPAs and accounting companies to find a qualified and eligible accounting professional at an affordable rate. CPAs and accounting firm owners are extremely busy, especially after the pandemic. They rarely have time to manage all the accounting services of their clients. Outsourcing is one option for them, but they are unsure which accounting services they can outsource. On the other hand, outsourced accounting company can handle numerous services at the same time.

Since the pandemic, CPA firms are increasingly opting for outsourcing and focusing mainly on skillsets and tasks that in-house teams can handle.

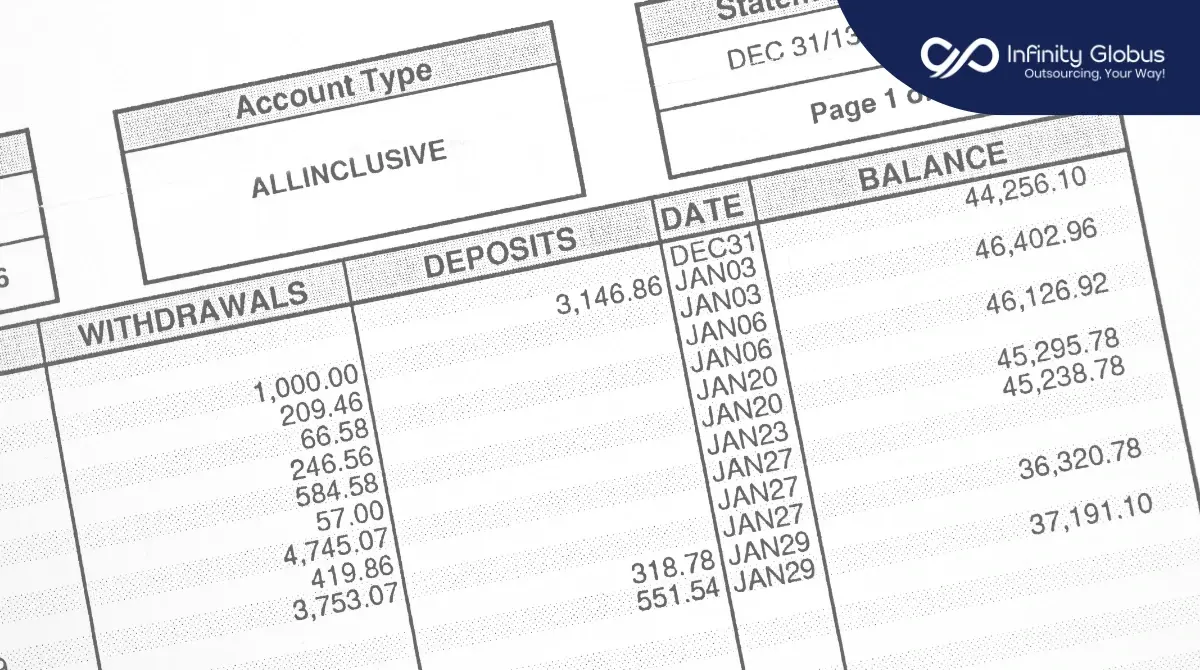

Outsourced Accounting is assigning tasks such as bookkeeping, tax preparation, and auditing to professionals (outside of the company) in the same country or another country. You can collaborate with an outsourcing accounting company and hire the candidates by interviewing them. These resources will handle day-to-day work operations just like your own employees.

Getting so many tax returns from clients at the end moment?

Are you a CPA, EA, or Accounting firm with high hopes and ambitions? Do you want to establish your business in the cutting-edge competition? Considering outsourcing companies for tax return preparation will help you achieve higher efficiency and get an opportunity to grow your business.

Achieving 10X is a dream for many CPA & accounting firms and most of them struggle to find the right pathway to accomplish their dream growth.

The world is changing in the fastest way possible, and so are the traditional staffing methods. The paper applications, in-office interviews, full-time staff etc are long gone things. One of the topmost challenges an accounting industry faces is staffing.

The world becomes a little smaller and more connected with each new advancement in technology and the web. This has resulted in some of the most rapid changes in recent history within the global payroll trends.