cirruscjn

10 Tax Write-Offs for Business Owners

10 Tax Write-Offs for Business Owners

If you’re a business owner, one of the many benefits of owning a business is the ability to take advantage of tax write-offs. Tax...

What Restaurants Owners Need To Know About Payroll

Payroll requirements for restaurants with tipped employees can be complex. Understanding the specific regulations that apply to tipped employees is crucial to avoid...

My Payroll Provider Asked Me To Sign A Form 8655…What Is It?

The Form 8655, also known as the Reporting Agent Authorization, is a document used by third-party reporting agents to authorize their clients to use their services for...

The FUTA Credit Reduction Explained

As a small business owner, it’s important to understand the impact of the Federal Unemployment Tax Act (FUTA) on your business. FUTA is a federal law that requires...

What Employers Should Know About Offering 401(k) Plans

Offering a 401(k) plan to your employees can be a great way to attract and retain top talent, while also helping your employees plan for their retirement. A 401(k) plan...

Officer-only Payroll: How to Pay Officers Under an S-corp

Managing an S-corp comes with some special tax benefits that sole proprietors don’t get to enjoy but also includes payroll responsibilities they don’t have. All S-corp...

Nanny Payroll: A Quick Guide for HouseHold Employers

If you’ve hired or are planning to hire a nanny to help your family with childcare, you’ll need to get to know your legal responsibilities to avoid trouble with the...

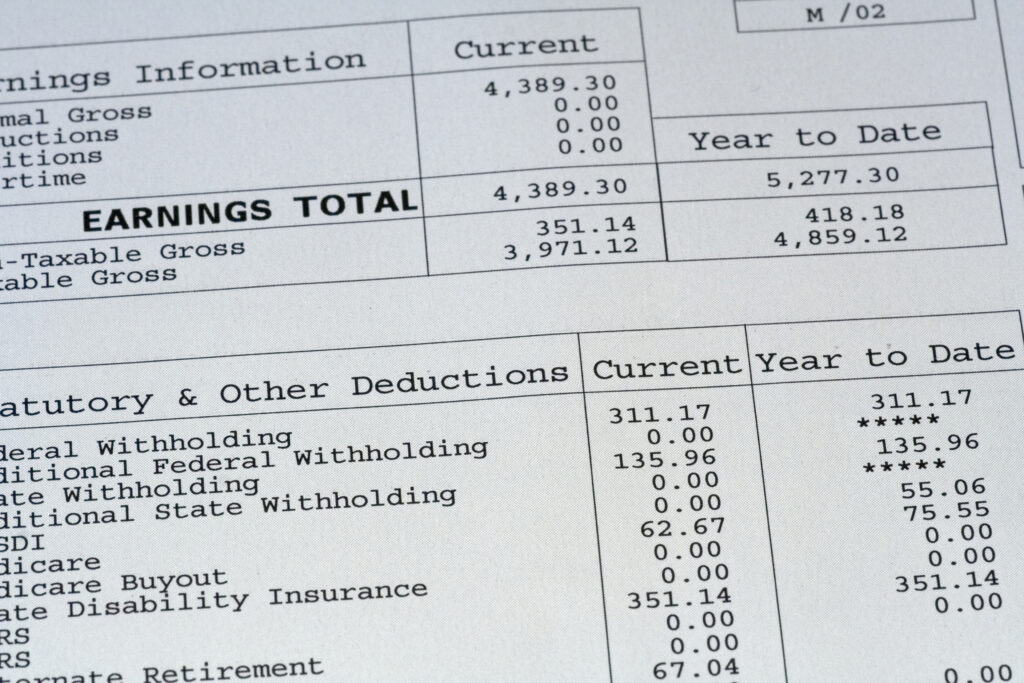

Pay Stubs: What They Should Include, Laws, & Requirements for Employers

A pay stub is a document, either electronic or paper, that shows details about an employee’s pay, such as hours worked, total wages, taxes and deductions, and net (take...

Church Payroll: Tax Exemptions & Clergy Payroll Nuances

Understanding church payroll is challenging for many religious organizations. There’s a big misconception that churches don’t pay payroll taxes, and some assume...