How Much Does Garage Keepers Insurance Cost?

Businesses providing automotive services such as auto body shops, parking garages, towing companies and service stations need to protect themselves against a variety of liabilities.

Posts about:

Businesses providing automotive services such as auto body shops, parking garages, towing companies and service stations need to protect themselves against a variety of liabilities.

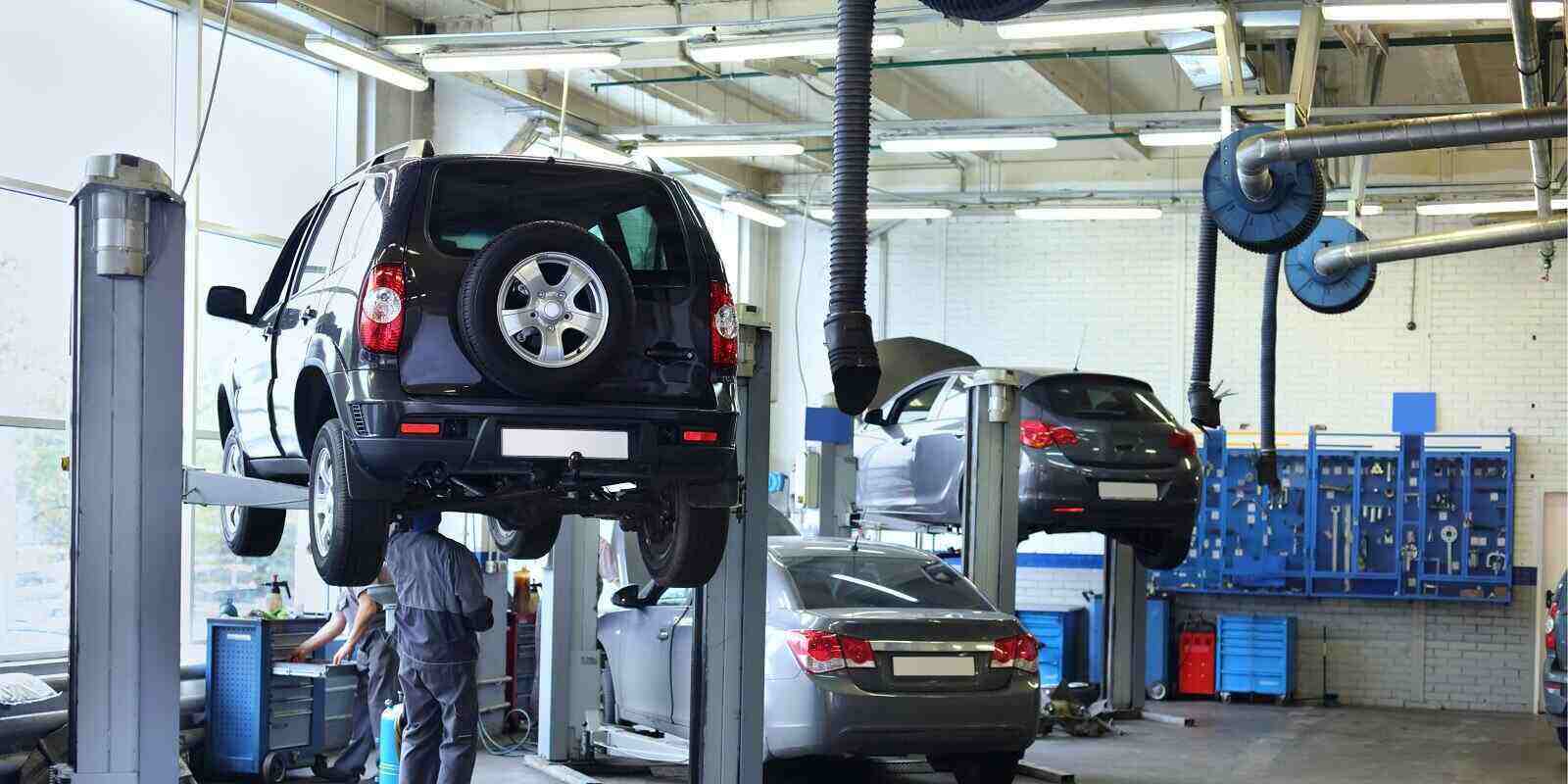

All automotive businesses, including auto body shops, service stations, towing companies and parking garages, risk inherent liabilities when providing service for customers’ vehicles.

Many auto body shops repair the damages vehicles sustain in collisions and sometimes, auto body shops must tow the vehicles they service. Therefore, it’s important for those businesses to acquire towing insurance in order to protect themselves from several types of liabilities. Here is a close look at towing insurance coverage and how it benefits auto body shops.

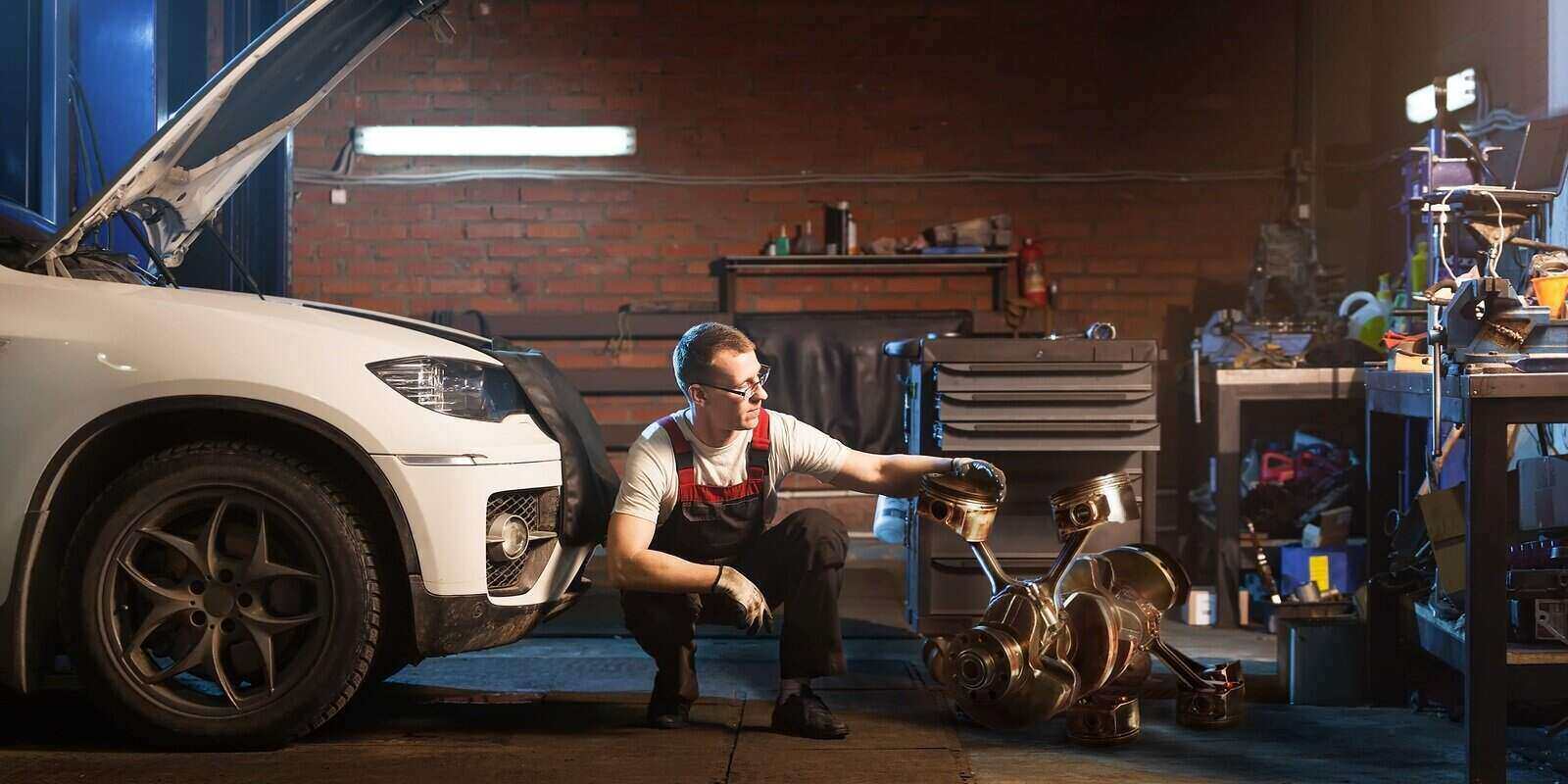

If you own any type of automotive service business, such as a car repair shop, a towing company, a service station, a parking garage or a carwash hub, you know there are certain risks the vehicles in your care are exposed to. It is essential to protect your business from these liabilities and the most effective way to do this is by purchasing a garage keepers insurance policy.

Emergency roadside service providers assist drivers after their vehicles break down, helping them return safely to their travels. Emergency services typically include mechanical labor at the location of a breakdown, towing a vehicle to the nearest repair site and lockout services (i.e. if your key is stolen, lost, or locked inside your vehicle) as well as delivering oil, gas, new tires or a battery.

Working with an insurance company that has experience providing insurance for towing businesses will not only manage the risks that are specific to their business but can help in getting the best rates for premiums. A professional, licensed insurance agent with experience in commercial towing insurance understands that towing insurance should be customized to cover the particular risks connected with each business. By comparing insurance policies, you can be confident that you are getting the best rates and paying only for the coverage your business needs.

Commercial towing insurance is customized insurance for businesses that provide commercial towing services. If your business owns or operates any kind of towing vehicle, read on to learn more about commercial towing insurance and what risks it covers.

Specialty insurance policies cover a wide range of objects and locations. Habitational insurance, or landlord insurance, is one example of a comprehensive policy that includes both general liability coverage and property coverage. More specifically, habitational/landlord insurance policies are designed to protect the owner of commercial properties that are rented to others (condominiums, apartment complexes, etc.). Here is a close look at habitational insurance, which is different from traditional homeowner’s insurance.

A homeowner’s association (HOA) should have insurance that protects the HOA against financial losses resulting from accidents or injuries that occur on the HOA premises. Without that insurance, each HOA member will be personally responsible to pay some portion of the loss. The specific type of insurance and coverage limits can be tailored to the needs of each HOA.

Tow truck towing a broken down car on the streetIf you own or operate a towing or hauling business, you probably already know what on-hook towing insurance is; in fact, the laws of your state may require you to have on-hook towing insurance as a condition to granting your business license. Whether your state requires that insurance or not, no towing or hauling business should operate without it.