Why Do I Need Garage Keepers Insurance?

If you are considering purchasing Garage Keepers insurance or Garage Keepers Legal Liability Insurance, it is important to consider how much you need to cover and a realistic idea of your budget.

Posts about:

If you are considering purchasing Garage Keepers insurance or Garage Keepers Legal Liability Insurance, it is important to consider how much you need to cover and a realistic idea of your budget.

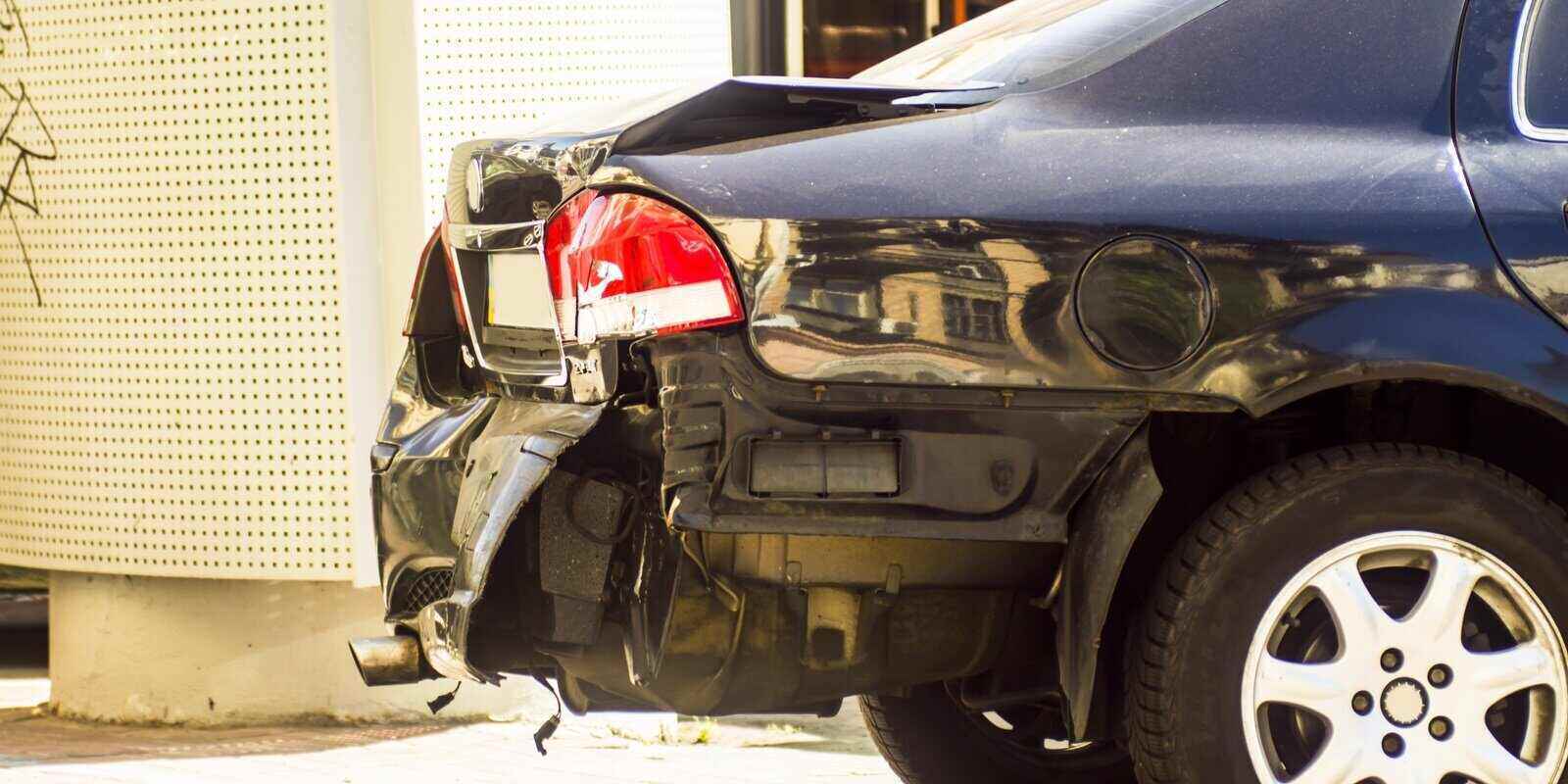

Cars can be expensive, especially when repairing one after an accident. During the period of repair, you could be facing an extended period without a vehicle. This can put a major strain on your finances and make it difficult to complete everyday tasks such as grocery shopping or getting to work.

Landlord insurance may appear to be straightforward, but there are many components to this type of insurance policy. If you are a landlord or are planning to become one, it is important to understand how this policy can benefit you. Here is the ultimate guide to landlord insurance for 2022.

Landlord insurance can be extremely beneficial to have if you have any type of rental property (condominiums, apartments, etc.). Whether you live in New York or California, there are multiple inherent risks associated with rental properties. However, it’s important to choose your policy carefully, as there are several factors that impact the cost of landlord insurance, including how high your premiums for this type of coverage can be. Here is a close look at this subject.

If you possess any sort of rental property, it’s important that you adequately protect yourself as well as the property with rental property policies, which represents a major investment. One of the most effective ways to do this is by purchasing landlord insurance. There are different types of landlord insurance policies and, as with any other form of protection, it is important to choose a policy carefully.

In recent years, Airbnb has become an increasingly popular option for many people seeking a comfortable yet affordable place to stay for one or several nights. According to Capital Counselor, the average duration of an Airbnb stay in the US in 2020 increased by 74%. Although bookings decreased amid the COVID-19 pandemic, reservations are now rising again.

There are certain inherent risks for landlords, associated with the tenants and properties they oversee. Those properties may include homes, apartments and condominiums. To protect themselves against the related claims and damages is through landlord insurance. Here is a close look at this type of policy.

Landlords must have some form of protection from the risks associated with having tenants, regardless of the type of rental properties they manage (apartments, condominiums, etc.) The most effective way to do this is by purchasing a landlord insurance policy.

Most auto insurance policies include multiple types of coverages to protect you in the event of an accident. One such coverage is medical payments insurance, which can be extremely helpful in cases involving crashes that result in severe injuries. Here is a close look at medical payments coverage.

Any company that tows vehicles is able to protect their business by having appropriate insurance designed for the risks associated with towing. Whether your company is a commercial tow truck business, towing disabled vehicles, or offers towing services as part of a repair shop or salvage or hauling business, commercial towing insurance will provide coverage for the possible risks.