The European real estate fund association, INREV, released its June Market Insights paper and stated that 79% of consensus survey participants expect income return to be the key driver of performance in the short-term. That’s the highest share who think that since the start of the series back in March 2022.

Historic analysis backs this up - income return is the stabilising factor for total returns accounting for over 70% of long-term performance within MSCI real estate indices. Yield movement delivers the frothy excitement, but income keeps the lights on.

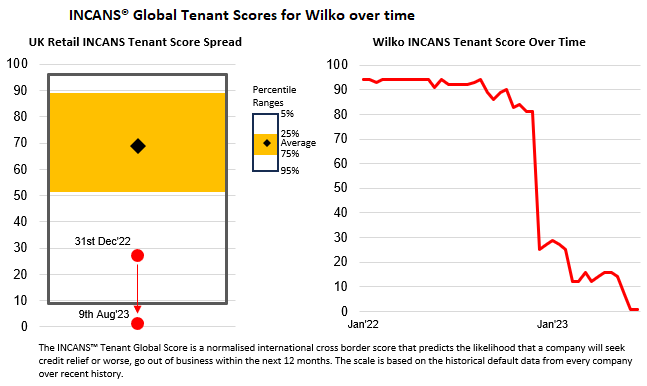

While investors focus on delivering income, bankruptcy rates have remained at elevated levels although new business registrations are finally rising (Eurostat, Q1-24). The risk a tenant could fail, or that a new business will remain around to meet its lease liabilities are significant. This means it is vital that investment opportunities have the right tenants to ensure a long-term, stable income stream and that managers monitor changes in the tenant risk profile in real-time.

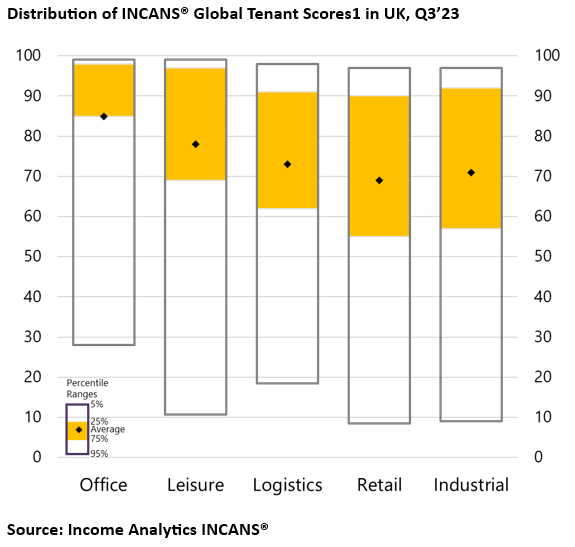

Income Analytics shows a significant range of risk across the top potential occupiers making it very important to understand the current credit risk of cashflows and the potential future risk of corporate failures.

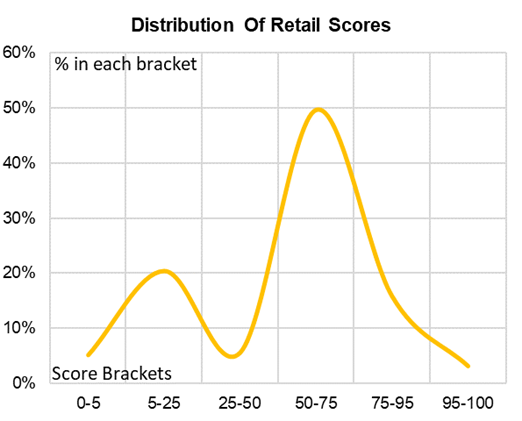

As a case study, the chart includes analysis for the top 1,300 Western European retail occupiers by revenue. These will be the typical retail occupiers of institutional grade retail assets. There is a wide dispersion of the INCANS Tenant Global Scores (from 1 to 100). The scores predict the likelihood that a company will week credit relief or fail, 1 being the worst.

The chart shows the distribution of companies across 6 brackets. Almost 50% of companies fall within the 50-75 bracket, however 20% of companies fall into the 5-25 bracket. This is “purgatory”. Companies in this bracket will either fail at this point or find a path to recovery.

It is vital for an investor to understand the mix of tenants they have across their retail and other sector assets to ensure they have a stable cashflow.