9 Best Practices for Effectively Managing an Outsourced Accounting Team for CPA Firms

The segment of professional services is evolving rapidly, and accounting is no exception. As firms grapple with shrinking margins, seasonal workload spikes, and an acute shortage of skilled talent, outsourcing has emerged as a strategic lever—not just a cost-cutting exercise.

Supporting this shift, recent data shows that the global finance and accounting business process outsourcing market is expected to grow at a CAGR of 9.3% from 2024 to 2030. This steady growth highlights a growing confidence in outsourcing as a long-term business strategy rather than a temporary fix.

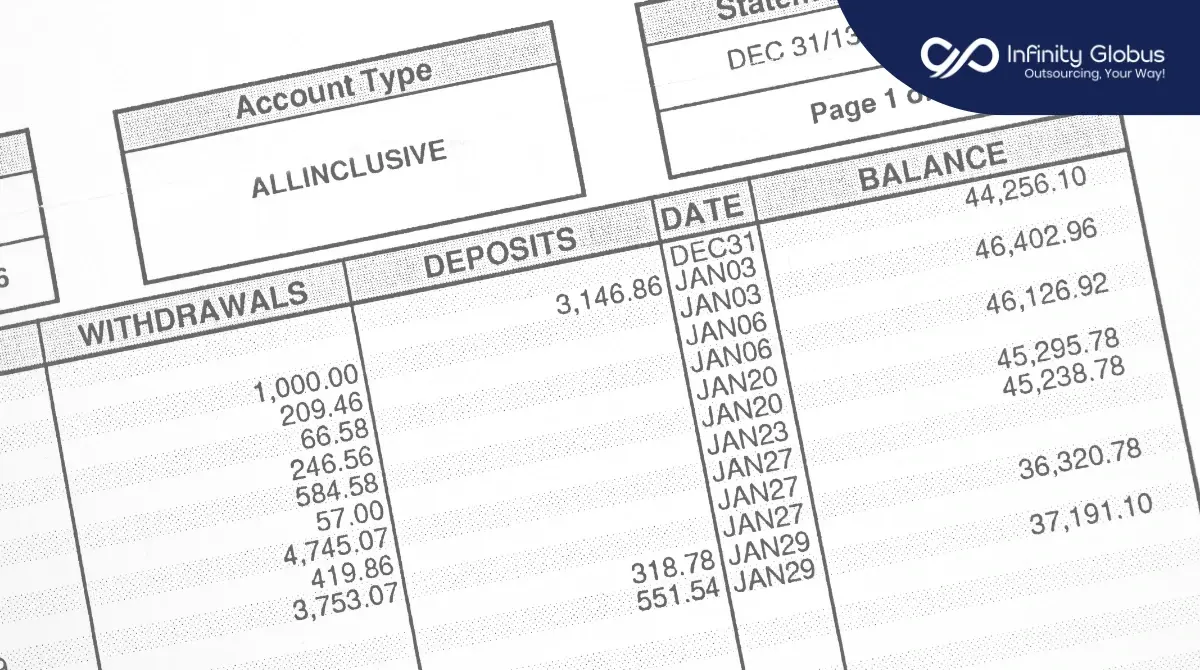

For CPA and accounting firms, outsourcing functions like bookkeeping, tax preparation, payroll, and audit services allows for increased efficiency, scalability, and access to world-class expertise. But the benefits can only be fully realized when outsourced teams are managed with precision, intention, and a deep understanding of remote operational dynamics.

This blog provides a comprehensive roadmap to help accounting firms optimize their outsourced teams for maximum ROI and long-term success.